When a Tax Bill Rewrites a Business Map: The Real Reason Sky Bet Crossed the Mediterranean

Sky Bet’s decision to relocate major operations to Malta made headlines; not because expansion is surprising for a £30 billion giant, but because the move came hand-in-hand with 250 job cuts in the UK.

Ilhan Irem Yuce

12/3/2025

“Follow the incentives, and you will find the truth.” — Warren Buffett

Sky Bet’s decision to relocate major operations to Malta made headlines. On the surface, it looked like a familiar corporate shuffle. But underneath? A masterclass in how regulation, taxation and political timing can quietly reshape an entire industry.

This wasn’t a PR play.

This wasn’t a branding refresh.

This was a defensive manoeuvre in a sector London just turned into a battleground.

The UK’s New Era: When Gambling Becomes a Political Tool

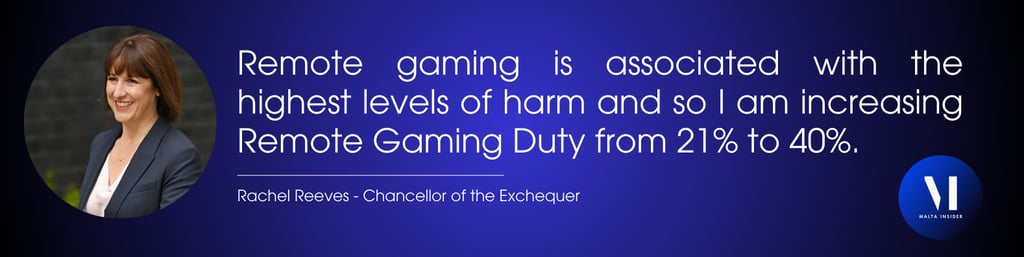

In November 2025, UK Chancellor Rachel Reeves announced one of the most aggressive fiscal strikes on online gambling in decades:

Remote Gaming Duty (RGD) nearly doubled — from 21% to 40%

Sports betting duty climbed from 15% to 25% for online wagers

VAT leakage from marketing? Under greater scrutiny

High-street betting shops? Barely touched

Bingo? Exempt entirely

This is not random.

This is policy with a motive.

A sector generating £12.6 billion a year suddenly became the government’s favourite ATM. With the UK lifting the two-child cap on benefits, the Treasury needed a clean revenue source. Online gambling - politically defenceless, socially controversial, and highly profitable - was an easy target.

But this story is not only about money.

UK regulators have long argued that online casinos and slots carry the highest harm footprint. In an age of behavioural addiction, instant apps, and frictionless spending, taxing online gambling became a tool of behavioural engineering: Make it more expensive to operate → reduce aggressive marketing → reduce harm.

Whether it works is debatable.

But the financial shockwaves were immediate.

Why This Story Matters More Than One Company

Sky Bet is just the headline.

The real story is the direction of the European gambling ecosystem.

Three forces are converging:

Governments are monetising “digital vice.” If people gamble on their phones, tax policy will follow them there. UK’s move is likely the beginning, not the end.

Multinationals are optimising faster than legislation can keep up. If borders are digital, money moves at the speed of strategy.

Malta is re-emerging as the regulatory optimisation hub of Europe. Not because of low taxes — those days are oversimplified; but because Malta provides:

EU certainty

Predictable frameworks

Operational substance options

Access to world-class talent

MiCA-era crypto payments infrastructure

A government that understands iGaming inside-out

This is not 2010’s “Malta gaming boom.” This is a more mature, more strategic, more compliance-driven chapter.

Where Economics Meets Geography: Why Malta Was the Only Logical Destination

Sky Bet didn’t simply open a Maltese company. They deployed a far more elegant structure:

A UK company with a Maltese branch, followed by relocating leadership and key functions to Malta.

This is the nuance that unlocks:

Cross-border corporate tax optimisation

EU VAT structuring

Operational presence without a full redomicile

Substance strong enough to withstand audits

Under Maltese rules:

Corporate tax: 35% nominal

But 30% refunded on distributed profits

Effective tax rate: 5%

So that £39 million UK corporation tax becomes ~£8 million.

Then comes the real engineering: VAT.

Through a well-known (but seldom spoken about) EU structure:

A ServiceCo established in Belgium, Luxembourg, or Ireland

VAT fully recoverable as an advertising business

ServiceCo opens a small Maltese branch

Branch joins Sky Bet’s Maltese VAT group

All intra-group advertising → 0% VAT

Result:

£22m UK VAT → 0

£24m Malta VAT → 0

In total, Sky Bet saves £45–50 million per year. And this is before calculating future UK tax hikes, consumer behaviour changes, or the impact of tightening compliance horizons.

The Uncomfortable Question No One Wants to Ask

For Sky Bet shareholders, this move is brilliant.

For the UK Treasury, it’s a warning shot.

For regulators, it’s a test case.

For the 250 employees who lost their jobs, it’s devastating.

But step back and ask the real question:

Do we want a world where multinational tax engineering outpaces democracy?

Because Sky Bet didn’t do anything illegal.

They simply did what global companies do:

They followed the incentives better than anyone else.

And until tax frameworks match the speed of digital business, there will always be another border to cross — and another Malta waiting on the other side.

Xoxo.

Address

Sliema - Malta

Contacts

+356 99270417

info@maltainsider.com